Disciplined, Cutting Edge Investment Management to Transform Your Portfolio

Shutzer Investments provides the personalized service you should expect from your financial partners. We begin by having in-depth discussions with you in order to learn and understand your particular financial needs and goals. Once we have agreed upon an Investment Strategy, we build a customized portfolio that will support and build your financial future.

You've Worked Hard

to Earn Success

You’ve run a successful business, department, or household….with a responsibility to steadily produce and create.

Customized Approach

Not Cookie Cutter

Traditional approaches use buy-and-hold portfolios with market-based results!

Shouldn’t you have specific solutions to maximize your needs?

You Deserve More

From Your Advisor

You deserve insightful advice, results-based investments, and “no excuse” service. If excellence is your goal, we invite you to learn more about our firm.

OUR FIDUCIARY RESPONSIBILITY

Fiduciary – An individual in whom another has placed the utmost trust and confidence to manage and protect property or money. The relationship wherein one person has an obligation to act for another’s benefit. ~ Legal Dictionary. We value the trust and confidence that our clients place in us and in return, it is not only our mission statement, it is our legal obligation to always put your interests first and provide objective, non-biased, advice and solutions. Our process is guided by the following principals:

Independent Research

Always use independent research when recommending investments

Due Diligence

Create a comprehensive due diligence process

Your Best Interest

Every decision is first based on the question, is this in the best interest of my client?

Opportunity Occurs Every Single Day

Ever wonder why so many people find investing so tedious, tiresome, and frustrating? The investment industry often focuses on theories and logic, while underappreciating real-life emotions that can drive people’s decisions.

Shutzer Investments aims to match investment strategies with client behaviors. Whether the match is to a comparison-based strategy, an absolute-based one, or an income-producing private approach…a good match may lead to reduced stress and improved long-term results.

Why Relative Strength?

The Relative Strength calculation that we employ does not go beyond basic arithmetic, and the end result is nothing more than a ranking system. Think about it like ranking your favorite sports team. Every sport has a ranking system – from golf to tennis to baseball to football – and they are all based upon the same philosophy. The better a player or team performs, the higher they go in the rankings. When they start to lose, they begin to fall in the rankings. We can affect the same type of ranking system based upon how an investment performs relative to others. The more it outperforms the alternatives, the stronger it is. When it begins to lose that strength, it falls in ranking. Success in equities is much like March Madness office pots. The ones that are most likely to win are usually going to win.

GROWTH DRIVERS

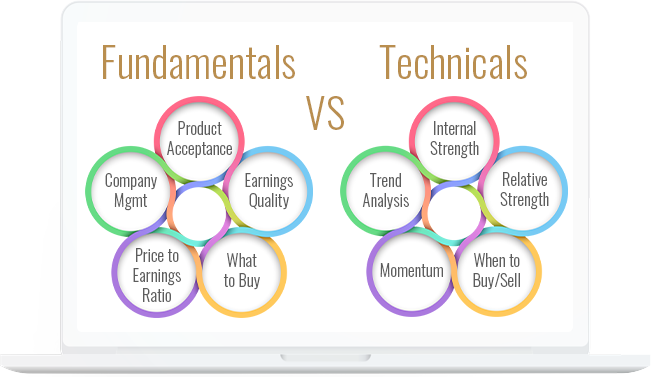

Fundamentals vs Technicals is the Key to Success

Shutzer Investments works to answer the question “when” to buy and just as importantly, “when” to sell. Shutzer Investments wants to determine whether demand or supply is controlling a security’s price. Is the stock outperforming the broad market? How high, or in some cases, how low can the stock go?

Unfortunately, there are very few advisors who effectively combine the fundamentals with the technicals. In a sense, they’re playing the piano with only one hand. While that may be a way to play a simple melody, you can play much better music if you play the piano with both hands. In fact, our game plan is grounded in this philosophy of combining the fundamentals with the technicals, or playing the piano with both hands.